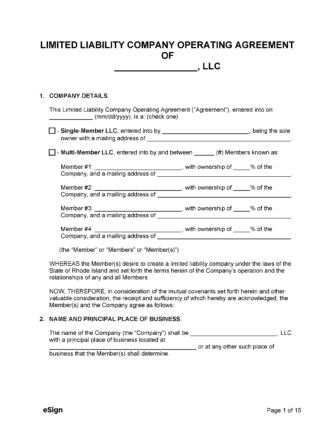

A Rhode Island LLC operating agreement is a document that binds the members of a limited liability company to an agreement regarding the ownership structure and internal operations of their company. The contract will include terms that delineate taxation, annual meetings, contributions, management, and distributions. Creating and executing an operating agreement protects the members from personal liability and prevents internal disagreements regarding ownership and financial interests.

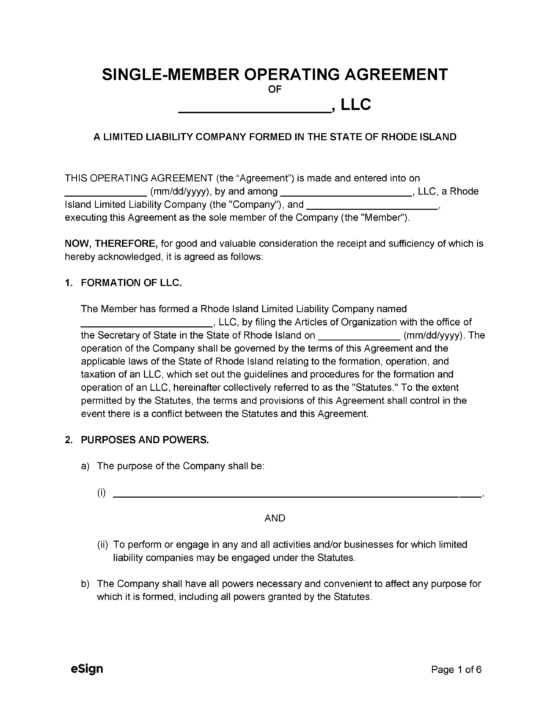

Single-Member LLC Operating Agreement – An internal document that governs the operations of an LLC that has one (1) owner.

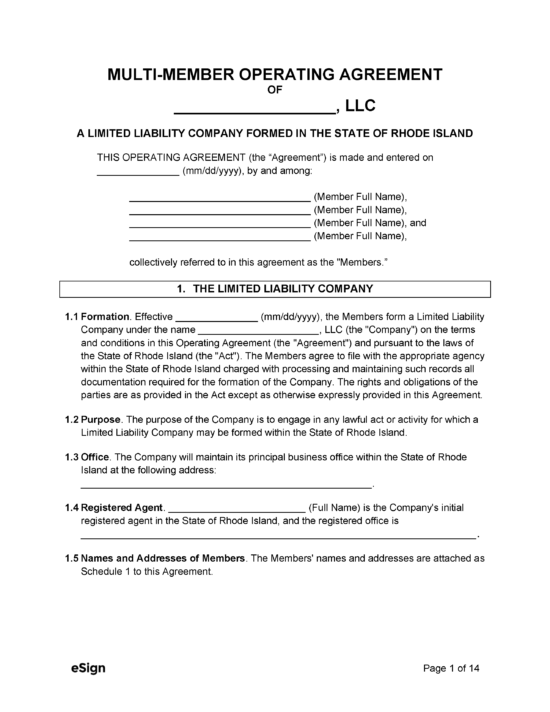

Multi-Member LLC Operating Agreement – Binds the members of an LLC with more than one (1) member to an agreement regarding their company.

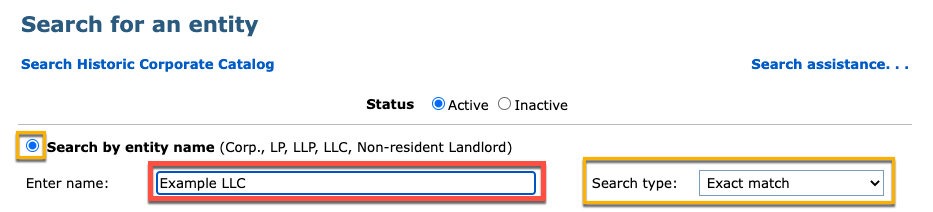

An LLC must select a name for their company that another company has not already registered in Rhode Island. Verify if a chosen name is available by following the steps below.

Entity names can be reserved for a period of one hundred twenty (120) days by completing and filing the online Reservation of Name form. The reservation fee is $50.

Any new company being created in Rhode Island is considered a domestic LLC. Domestic companies are registered after they have filed the Articles of Organization with the Department of State and been accepted. Filing can be completed online, by mail, or in person.

File Online

File by Mail / In Person

A foreign LLC is a company that is already registered in another state and is expanding its operations into Rhode Island. Foreign LLCs register using an Application for Registration and a Certificate of Good Standing from their original jurisdiction. Filing must be completed by mail or in person.

File by Mail / In Person

Office of the Secretary of State

Business Services Division

148 W. River Street

Providence, Rhode Island 02904-2615

While the Articles of Organization relay a company’s organization for recognition by the state, an operating agreement defines the LLC’s internal structure, rules, and operations. Although the agreement isn’t required, the governance of the LLC will default to state law in the absence of one. Furthermore, an agreement will help define the company as an LLC for tax purposes.

Unless the LLC is a single-member company without employees that doesn’t wish to be taxed as a corporation, they will need to apply for an Employer Identification Number (EIN) from the IRS. The Application for EIN can be filed by mail at the address below or online. There is no application fee.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Rhode Island LLCs are required to file an annual report with the Department of State to provide updates on their company’s status. The report is due between September 1st and November 1st, starting the year after the LLC was formed. Companies can download the Annual Report and mail or hand-deliver it to the Business Services Division (address below) once completed. The filing fee is $50. Filing can also be completed online.

Office of the Secretary of State

Business Services Division

148 W. River Street

Providence, Rhode Island 02904-2615

Filing Options: Online (Domestic LLCs only) / By Mail

Costs:

Forms:

Links: